U.S. Federal Reserve officials have signaled plans for a half-point interest rate hike at their meeting this month, and while that would be a step down from recent rate increases, new projections issued then could show a policy rate headed toward levels last seen on the eve of the 2007 financial crisis.

Moreover, in an outlook that could lean against market expectations for rate cuts by the end of next year, the 19 U.S. central bankers’ new forecasts may well show the federal funds rate remaining at that elevated level at least through 2023.

The updated outlooks will be a fresh chance for Fed officials to show how their “raise and hold” strategy is expected to play out in terms of the ultimate level of the overnight policy rate, and the progress of growth, inflation and unemployment in what they hope is a resilient economy.

The rate-setting Federal Open Market Committee meets on Dec. 13-14, capping a volatile year that saw the central bank respond to the fastest outbreak of inflation since the 1980s with the fastest increase in interest rates since then to try to offset it. That aggressive response sent a shock through the financial system that at one stage erased nearly $12 trillion of U.S. stock market value and more recently pushed home mortgages rates to 7% for a population used to cheap money.

Equity markets have risen lately and rocketed this week when Fed Chair Jerome Powell, in what were likely his last public remarks before the meeting, said the Fed was ready to slow down from a string of four straight three-quarter-point rate hikes – a potentially inconvenient outcome for a Fed chair who wants to keep financial conditions tight and keep public expectations firmly focused on the inflation battle.

Fed officials from San Francisco Fed President Mary Daly to St. Louis Fed President James Bullard, often at opposite ends of recent policy debates, have both discussed rates possibly rising above 5% next year. The last time the Fed’s policy rate rose above that point was June 2006 to July 2007, at the onset of the 2007 to 2009 financial crisis and recession, when the federal funds rate crested at 5.25%.

If there is concern about crossing that line, Fed officials have not voiced it. New York Fed President and FOMC Vice Chair John Williams said recently he would expect a “restrictive” interest rate “through at least next year.”

INFLATION ‘MUCH TOO HIGH’

Powell in a lengthy conversation at the Brookings Institution this week sketched out what may indeed be a lengthy transition for the Fed and the U.S. economy to a world of only slowly receding inflation, high interest rates, and potentially chronic worker shortages.

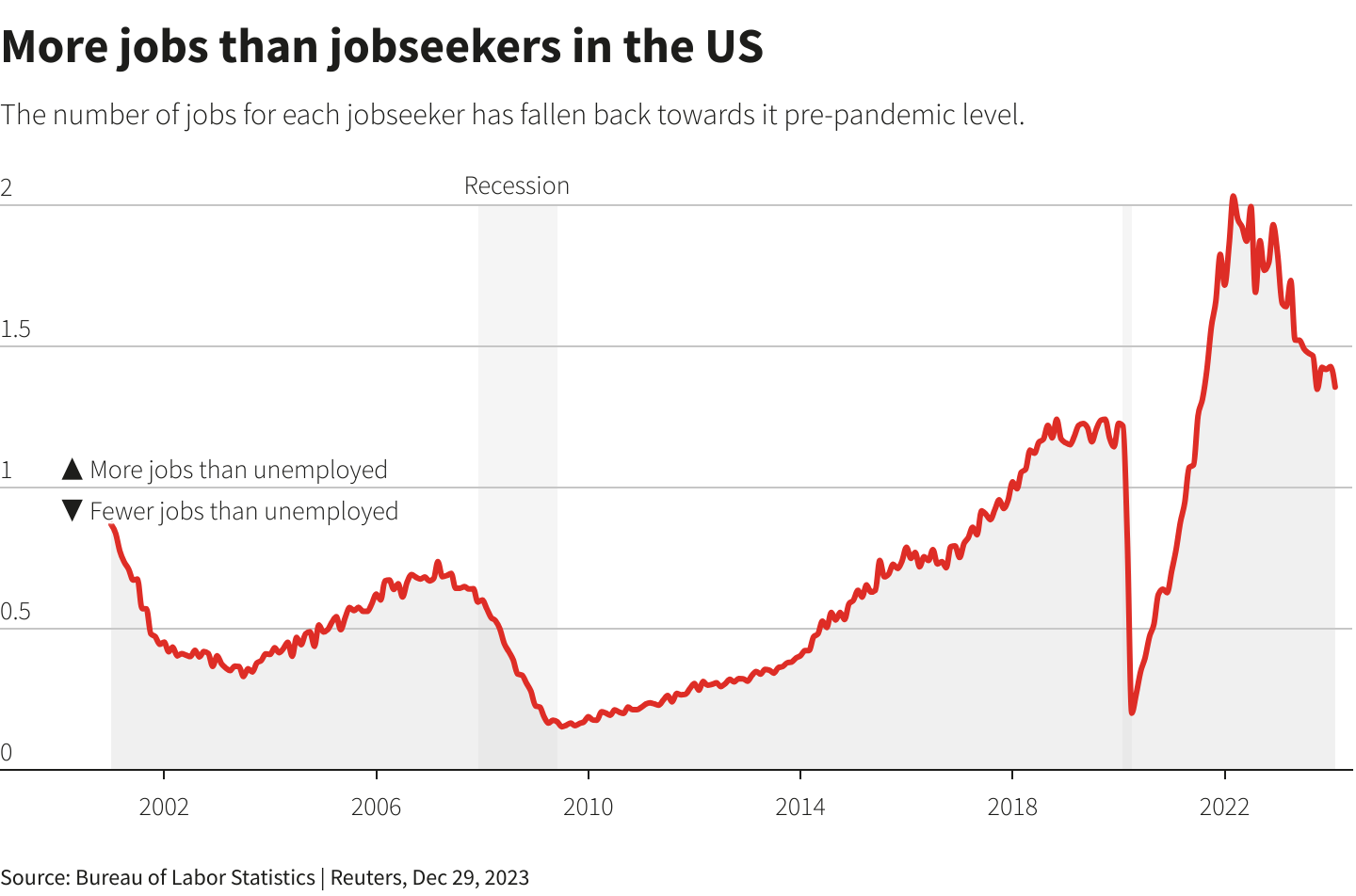

To lower the pace of price increases, he said it was clear that energy needed to be sapped from a job market where the demand for workers remains far beyond the number of people ready to take jobs – an imbalance lodged in U.S. demographics and immigration policy, and amplified by the pandemic.

Embedded in the new Summary of Economic Projections will be estimates of just how big a toll Fed officials feel will be paid in terms of rising unemployment and slower growth as its policies begin to bite.

Data released Thursday showed the Fed’s preferred measure of inflation was 6% in October, a drop from September’s 6.3% rate and the lowest this year but still triple the Fed’s 2% target.

“It will take substantially more evidence to give comfort that inflation is actually declining. By any standard, inflation remains much too high,” Powell said.

Employment data on Friday will estimate payroll growth for November, another important piece of information for policymakers who feel prices are unlikely to fall until job and wage growth slow.

The economy has been adding an average 407,000 jobs per month this year. Though the pace dipped under 290,000 from August through October, and analysts expect a figure as low as 200,000 new jobs added for November, it is still above the 183,000 added monthly in the decade before the pandemic.

PROJECTIONS WAY OFF THE MARK

Fed projections have raced through the year to catch up with reality. As of last December, the median projection by officials was that their policy rate would end 2022 at just 0.9%, with the preferred inflation measure falling to 2.6% – an implicit bet that inflation would in part ease on its own. The highest individual fed funds projection was just 1.1%.

They were off by a factor of four. With the expected half-point increase at the next meeting, the policy rate will end the year in a range between 4.25% and 4.5%.

Powell this week acknowledged the difficulty forecasting in an environment still roiled by the pandemic and its after-effects.

But there’s also little choice as the central bank ends its headlong drive to “frontload” rate hikes to tighten borrowing and credit conditions – the mechanism through which the Fed tries to change the course of the economy – and begins, as Powell described it, to “feel” the way to a stopping point.

As of September, the Fed narrative still included a benign outcome of continued growth, steady progress on inflation, and an unemployment rate rising less than a percentage point, to 4.4% at the end of next year from the current 3.7% – what some have referred to as an “immaculate disinflation” coming at little cost to the real economy.

The fed funds rate was seen ending 2023 at 4.6%.

It will, Powell said, need to be “somewhat higher.” The upcoming projections will show that final destination perhaps coming into view, and give a better assessment of the possible cost as well.