This post has already been read 1251 times!

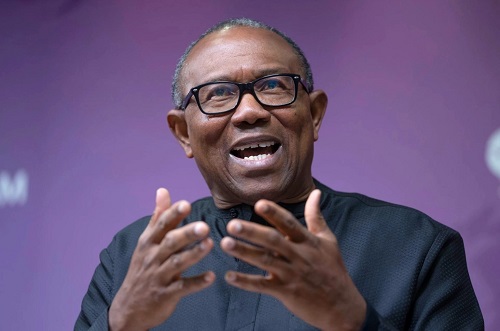

The recent decision by the Monetary Policy Committee (MPC) to increase the Monetary Policy Rate (MPR) to 22.5% and the Cash Reserve Ratio (CRR) to 45% has been criticized by the Labour Party presidential candidate in the last general election, Mr. Peter Obi. He believes that this decision will worsen the economic situation of many Nigerian households and be counterproductive in managing money supply. Obi mentioned that the measure would likely lead to more job losses in the productive sector, particularly in manufacturing and other sectors reliant on bank loans and credit facilities.

The MPC of the Central Bank of Nigeria raised the benchmark interest rate by 400 basis points to a record 22.75%. CBN Governor, Olayemi Cardoso, announced this decision during the first MPC meeting of the year in Abuja.

Obi argued that tightening liquidity in the financial system does not enhance productivity, especially in food production, which he identified as a major driver of inflation in Nigeria. He suggested that addressing the issue of insecurity in the country would be the most critical way to manage high inflation and declining production. By improving security conditions, there would be an increase in food and crude oil production, leading to an overall boost in production and potentially lowering the prices of goods, particularly food.

Obi highlighted that only about 12% of the total money in circulation, which amounts to N3.6 trillion, is within the banking system, meaning that 88%, or approximately N3.2 trillion, is outside the banking system. He emphasized that the recent measures taken by the MPC are likely to have adverse effects and not achieve the intended purpose of managing money supply. With the MPR hike pushing interest rates on loans above 30%, it would be challenging for real sector operators, especially manufacturers and SMEs, to repay loans, likely resulting in increased bad loans and worsening the economic situation.

In summary, Obi believes that combating insecurity in Nigeria and increasing production, especially in food and crude oil sectors, is crucial to managing high inflation and declining production. By restoring confidence in foreign investments, the country could potentially improve its productivity and economic situation. He urged for practical solutions and cautioned against solely relying on classical economic theories, emphasizing the need for originality and results to address the current crisis.

Comments